|

最近大众信托新推出的 《大众e-安逸混合资产基金》应该 加入你目前的 Portfolio 吗? 如果你现在 Investment Portfolio 都是📍高风险的基金,可以考虑这个 中风险 本地 基金来 balance up 你的Portfolio. ⚖️⚖️

up tp 35% 的 equity 会投资于: Consumer, Communication, Technology sector. Communication: Online shopping, home entertainment, social media, Gaming. Technology: Software, Hardware, Semiconductors, Automotive, Artificial intelligence.... 可以参考以下图片:

总结: 如果你不想要太大风险的股票基金,可是又想寻找回酬较高于 > FIXED DEPOSIT 定期存款, 同时又可以有机会拿到像股票基金的回酬,这类似的混合基金就适合你👍

happy investment!

0 Comments

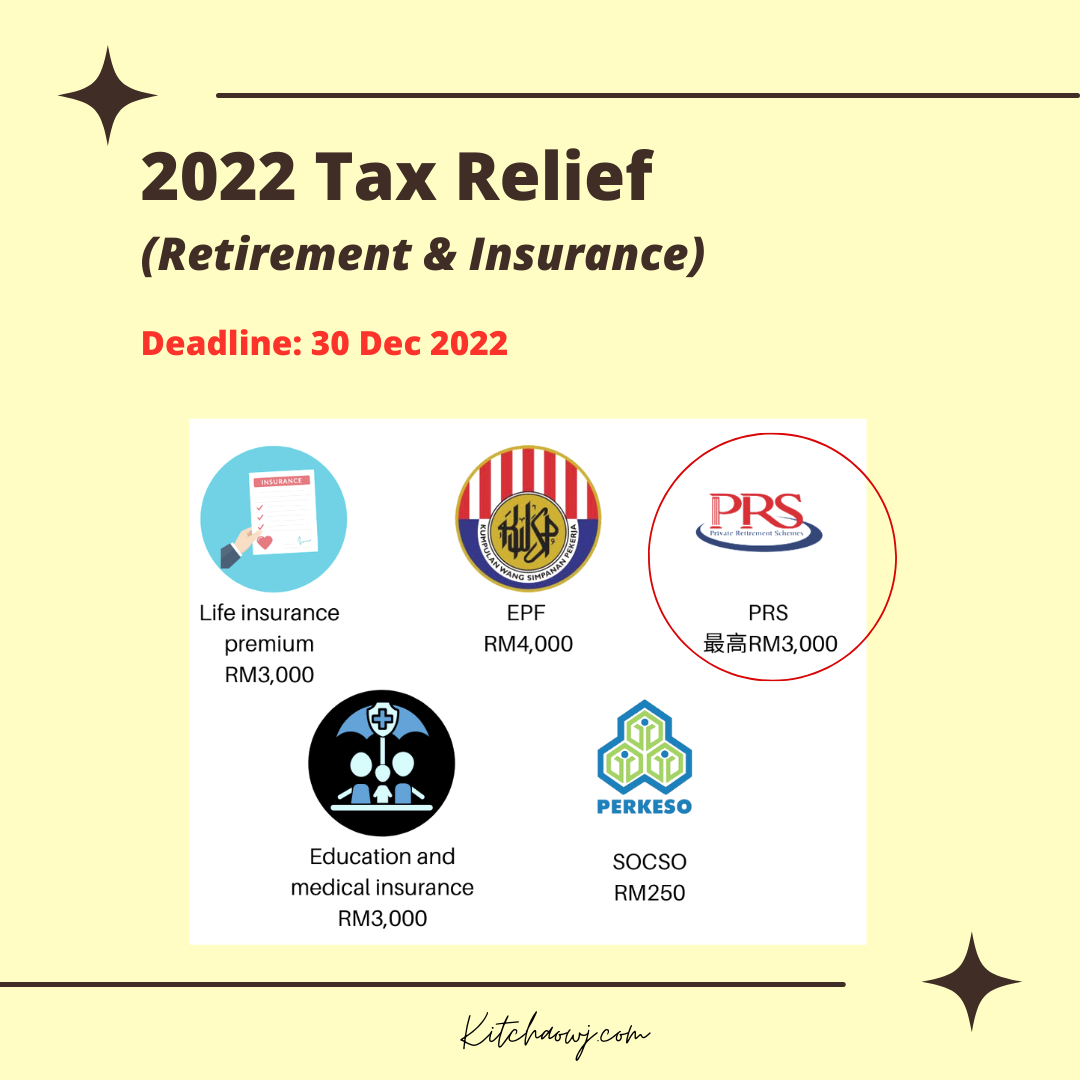

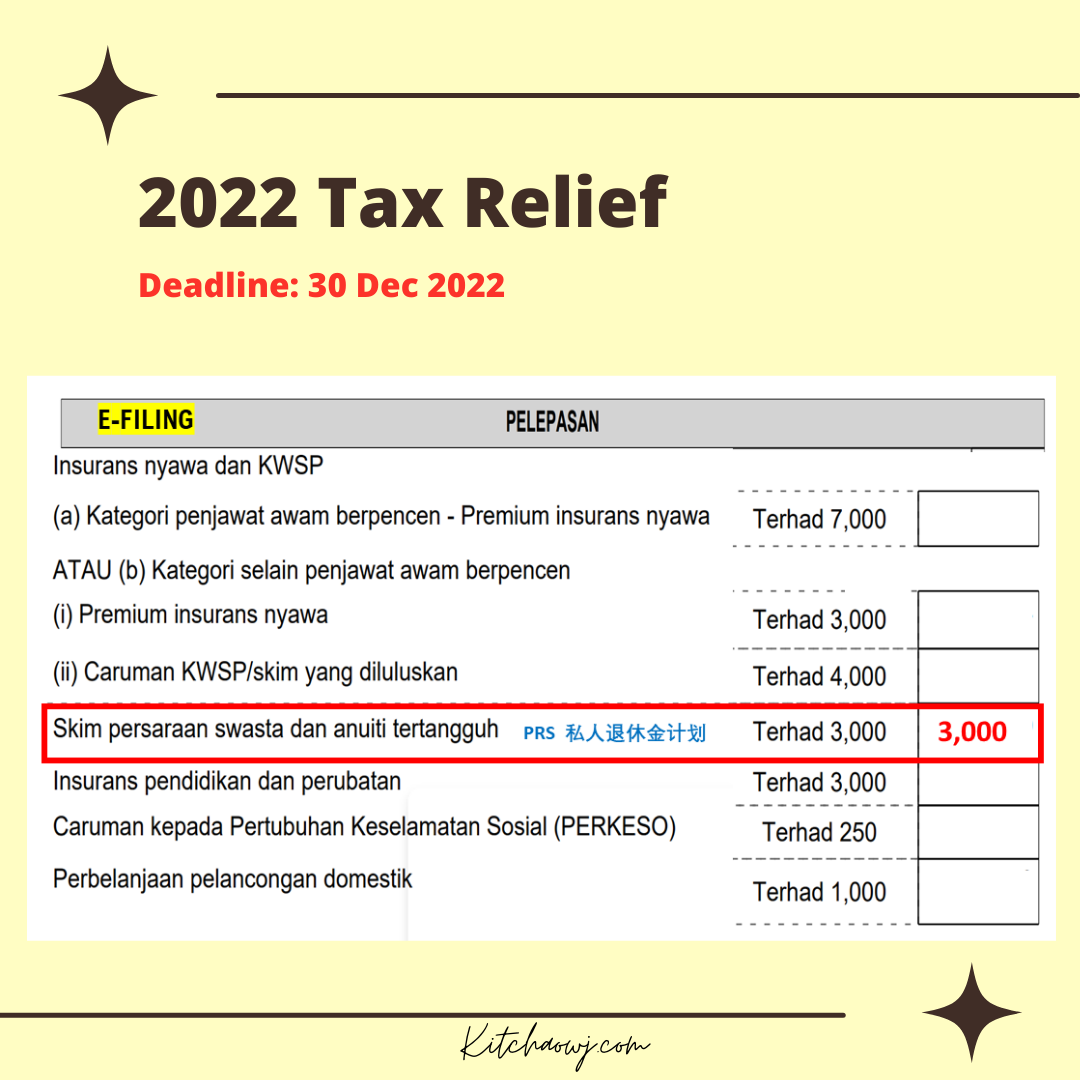

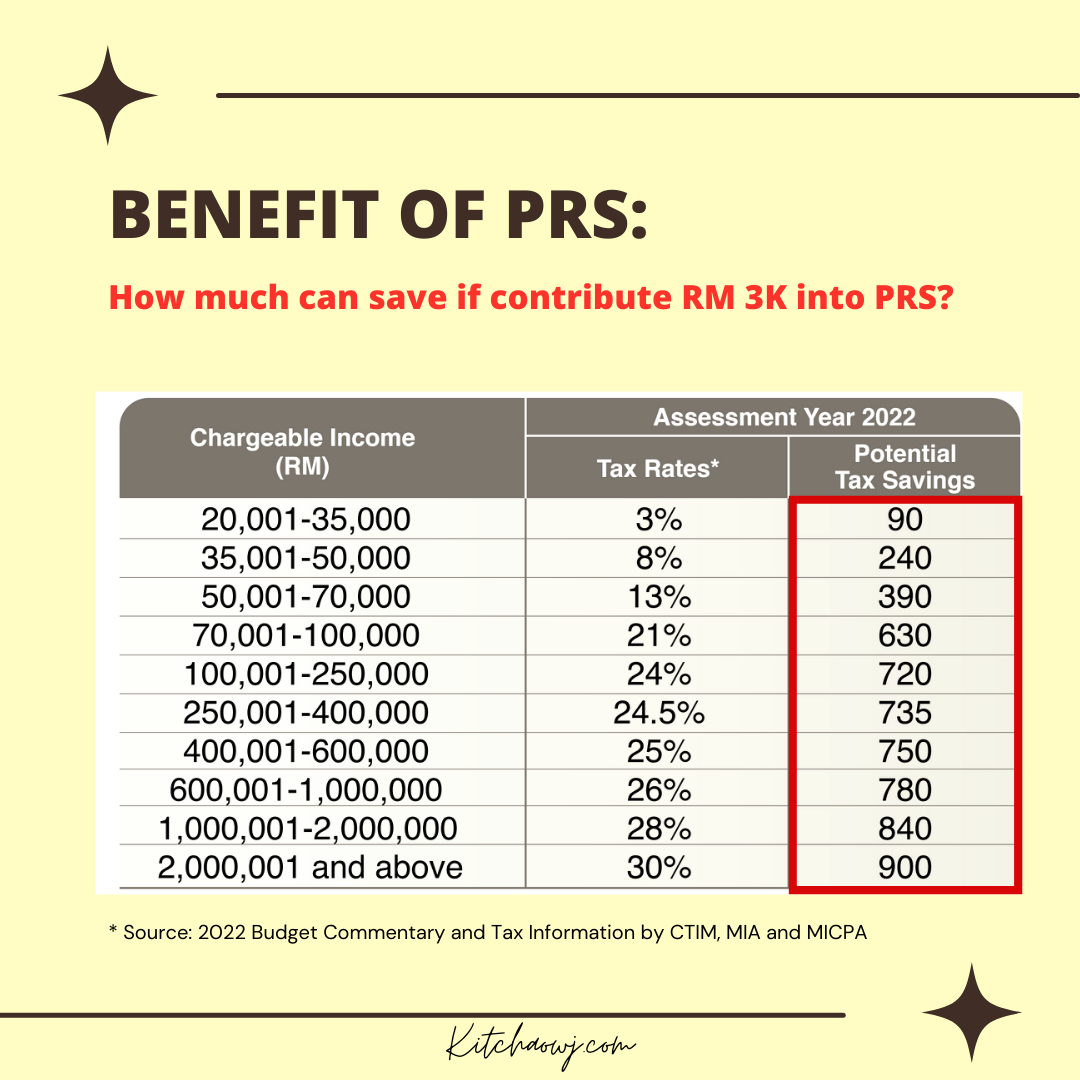

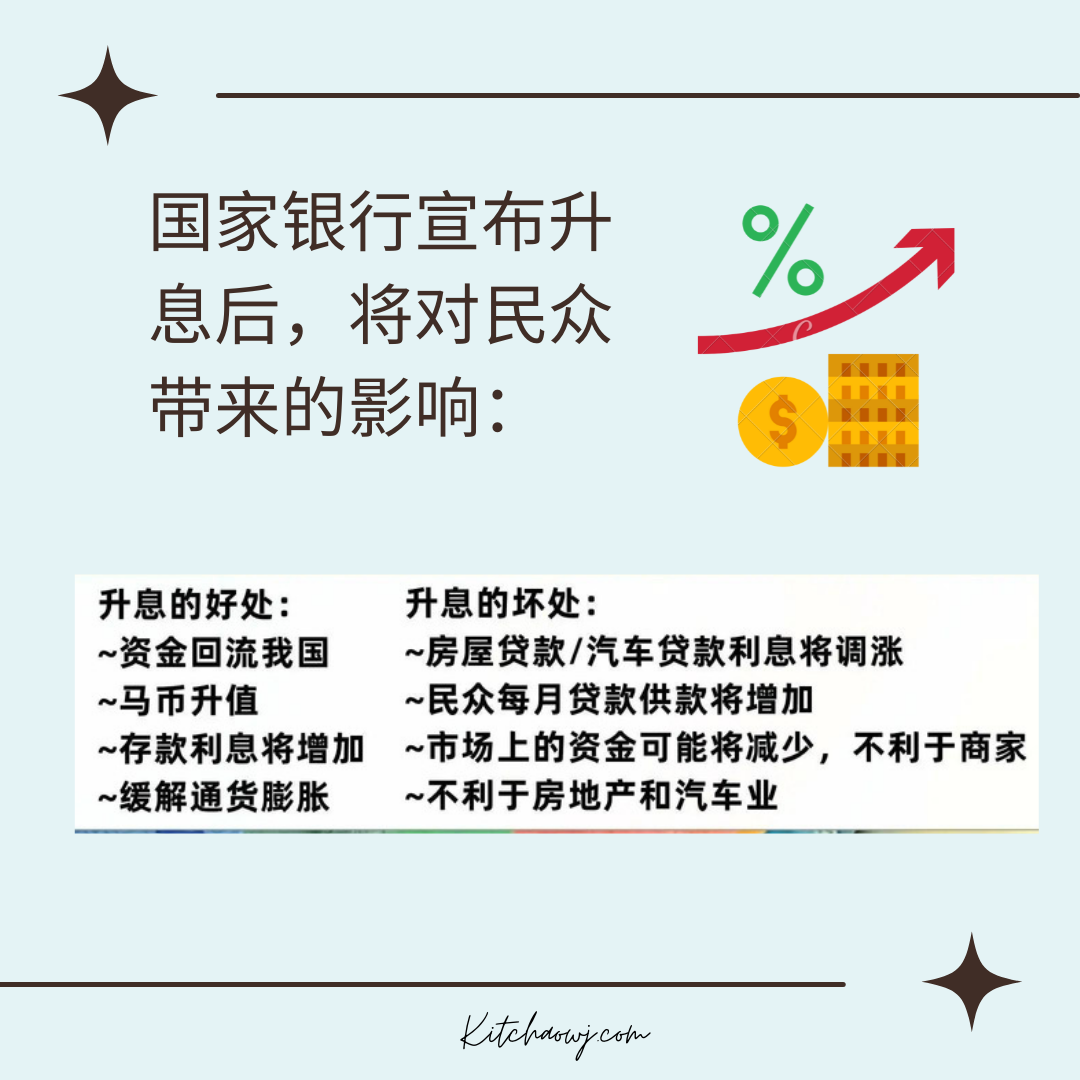

Hello December! It Is the final month of the year 2022. It's a final sprint to fulfilling your tax relief. Have you contributed to your Private Retirement Scheme (PRS) Tax Relief of RM3,000? 1. Why PRS? The PRS Tax Relief was specially introduced to encourage you to save more for your retirement. The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3,000 by the Inland Revenue Board of Malaysia. 2. PRS Tax Relief Column 2. How Much do i Save? This table provides an illustration of the tax savings amount you could enjoy from your annual RM3,000 PRS contributions. For example, if your tax bracket is 24%, your RM3,000 PRS contributions will give you tax savings of RM720. Malaysians cannot afford to retire with just their EPF savings alone. With retirement planning far down the list of priorities among youths, the EPF has consistently stated that a majority of Malaysians do not have enough money in their EPF accounts to last them for long. In 2014 and again in 2017, the EPF found that a staggering 68% of members aged 54 have less than RM50,000 in their EPF accounts, which the EPF estimates will only last them for 4.5 years! This has forced many to delay retirement or find alternate means of income well into old age. To combat the lack of retirement savings, the Private Retirement Scheme (PRS) was introduced in 2012 and sought to encourage people to build their retirement income in another way beyond EPF. By staying on course with a retirement scheme like PRS, you get the best of both worlds – enjoying tax relief whilst saving more for your retirement! happy INVESTMENT!时隔4年再升息 (OPR),对人民有什么影响?马来西亚国家银行在2022年5月11日,宣布将隔夜政策利率(OPR)调涨25个基点,至最新的2.00%。这也是相隔超过4年后,再度宣布升息。 单在2020年的一年内,国家银行就把隔夜政策利率调低了4次: 而一般上在国家银行正式宣布升息后,国内的各家银行,也将会陆续的宣布随着升息,宣布调高基准率(BR)以及贷款基本利率(BLR),以及定期存款的利率。 其中随着利息调高,房贷、车贷还款额将开始提高。借贷人在还款时要多加留意,要检查最新的还款额,以免还少了被视为拖欠贷款,而遭征收额外利息。 例如,在浮动利率的汽车贷款方面,若你贷款大约7万多令吉,升息后每月供款只增加大约16令吉左右。而在房屋贷款方面,若你贷款40万,分期付款35年,每月供款大约增加60多令吉。 回顾一下什么叫隔夜政策利率 OPR 隔夜政策利率 OPR 是我们的中央银行,也就是马来西亚国家银行(Bank Negara Malaysia,简称BNM)设定的一个隔夜利息,用来决定金融机构之间相互借贷所需支付的利息。简单来说,每一间银行每天的现金储备水平,都会因为放贷活动和客户的存款和取款情况而有所不同。

To celebrate her 10th years work anniversary in Unit Trust.

Finally she launch a Happygirl finance account to share information to all her investors. Please feel free to add my new ig: Happygirl Finance (@happygirlfinance) • Instagram photos and videos thank you ! 这两年,相信您会发觉公司推出无数的科技股票基金,都比较专注在于全球(美国,亚洲等国家)。如果您有分散投资,相信您也获得不错的回酬了。一下是这两年最新 e-series系列的基金:

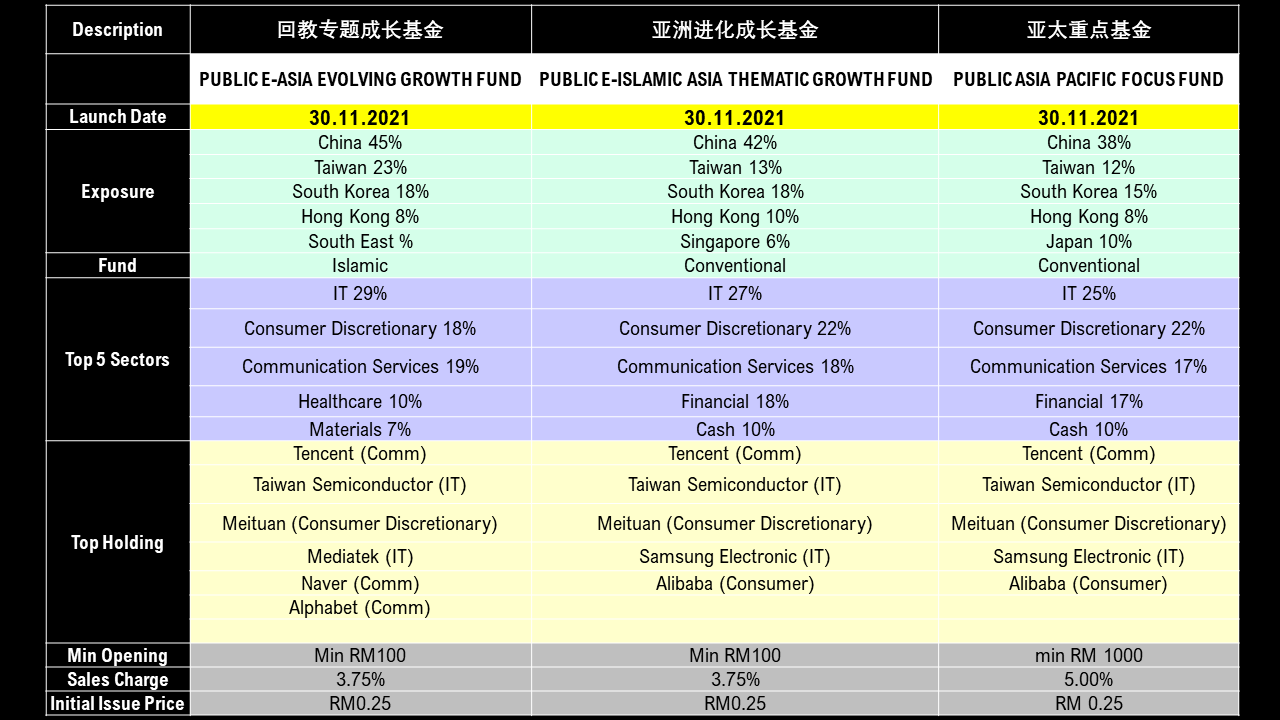

我也做了一个以上最新基金的总回酬报告: ##您可以看每个基金都表现都很好! 大家开始意识到了地球给的警报,在近十几年开始节能减碳排放.尤其碳中和将会是科技公司下一个“必争之地”。Google、苹果、Facebook、微软等世界级科技巨头引领了100%可再生能源的潮流——当然,也有不少中国科技企业也已经在纷纷致力于“碳中和”。它们当中,有的以绿色材料取代传统材料,有的通过智能家电实现智能遥控,有的研发节能的空调制冷系统,有的则打造绿色供应链。不约而同的是,这些科技企业正在通过创新,融入到“碳中和”的大蓝图中去。 我们的公司也不例外,这两年也捉紧机会投资于这些领域。从这里的分析,可以看到大致上这些新的基金投资领域都比较专注于科技,健康科技,金融科技等等的股票 11 月30号推出3种新基金!紧 握 亚 洲 日 新 月 异 的 市 场 趋 势其实自己本身也很蛮期待亚洲基金。这次推出的e-series系列的亚洲基金是我们公司第一种亚洲e-series基金。 推售三大亚洲系列科技基金。 1) 大众回教专题成长基金 (Public e-Islamic Thematic Growth Fund ) 2) 大众亚洲进化成长基金 (Public e - Asia Evolving Growth Fund) 3) 大众亚太重点基金(Public Asia Pacific Focus Fund) 基金特点主要投资在亚洲,亚太国家市场如: 中国,台湾,南韩,香港,新加坡等。。。 基金比例以科技股为重,其次通讯,日常生活,医药股等领域。

不担心,这些疑问都可以一一解答你。可以联系这里 Kit Chao- Group Agency Manager | Linktree 这里我给大家做了一个summary: 这些基金都是紧 握 亚 洲 日 新 月 异 的 市 场 趋 势! 更多基金详情:

|

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |

||||||||||||||||||||||||||||||||||||