如果你每年有固定收入,一次过投资好,还是分期投资好?我们假设有五个投资者,每年2000元供投资用: 1.Peter Perfect 他是一个完美的市场预测者,每年都能在股市最低点,投资2000元。 2.Ashley Action 她很冲动,每年一拿到2000元,就立刻投资股市。 3.Matthew Monthly 他很稳健,把2000元分成12等分,每个月投资。也就是所谓的平均成本法。 4.Rosie Rotten 她是最蹩脚的投资者,每年都在股市最高点,投资2000元。 5.Larry Linger 他每年把2000存起来(债券)。他担心自己会买在股市最高点,一直等待股市大跌,才决定投资。 谁是大赢家呢? 你认为谁赚得最多钱的? 根据那篇文章统计出来,从1987年到2006年共20年,投资在S&P500指数上。

Regardless of the time period considered, the rankings turn out to be remarkably similar. We analysed all 62 rolling 20-year periods dating back to 1926 (e.g., 1926–1945, 1927–1946, etc.). 这个故事告诉我们什么?只要你有多余的钱,不必等了,直接就拿来投资。 没有人能够象Peter每次都买在最低点。即使你的运气差到每年都买在最高点,你的投资回报也不会输给Peter多少。 读了这篇文章,相信对股市上下就心安了。 只要还有固定收入,每年,每月,有多余的钱,找只好股/信托来投资就可以了。 我们无法预测股市现在是高点,还是低点。但长远来说,股市是向上的。只要我们买的是好股,就不用担心太多了。 参考于:

by Mark W. Riepe, CFA, Senior Vice President, Schwab Center for Financial Research June 29, 2007. Reprinted from the June 2007 issue of Schwab Investing Insights®, a monthly publication for Schwab clients.

0 Comments

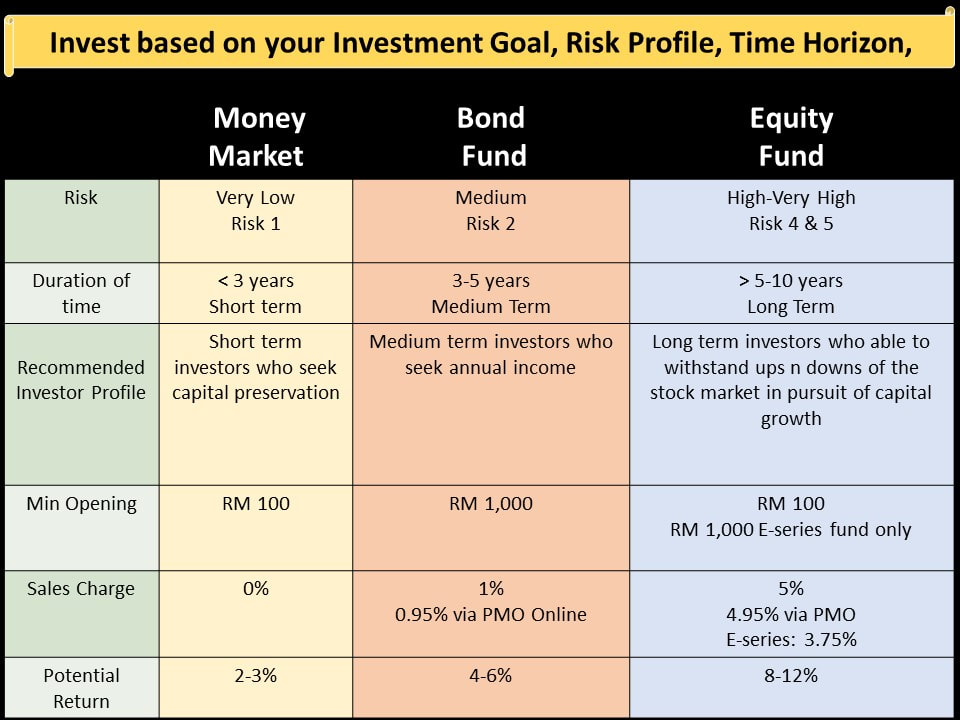

There are 3 main Type of Fund:

I notice that people's first impression toward unit trust fund is that all funds are high risk fund. In fact there are lowest risk fund namely money market fund and bond fund. I did a simple explanation for a better understanding on different fund, there is different risk, different return and loss. Hope it helps you to choose a better, suitable fund. Summary:with just 5 min read, you got better understanding ..1. Money Market Fund (Lowest Risk, Emergency Fund)What Is MM

Fund Objective

Suitable To

Return

Suggestion Investment Period

WHAT IS MONEY MARKET BENEFITS: •Min opening: RM 100 only •0% Service Charge •Flexible to withdraw, 2-3 working days. •Safe, Lowest Risk •Invest/redeem via PMO online, very convenient. •Free Fund Consultation 2. Bond Fund (Medium Risk)

What is Bond Fund: Investing into debt securities issue by Government & Corporations. Debt securities issue by

Suitable To:

Return: 4-6% per annum Suggestion Investment Period

WHAT IS BOND FUND BENEFITS:

3. Equity Fund (High/Very High Risk)What is:

Suitable to:

Return: 8-12% Suggestion Investment Period

NOTE: There is not a contract basis for the investment period. That is a recommended investment period only. There is no exit fees/penalty for the early redemption . HOTTEST FUND-EQUITY FUND!!!!

Each Equity fund is differentiated based on its investment features 1.Market Capitalisation (Large Cap, Mid Cap, Small Cap) 2.Sector (property, consumer, telco & infrastructure, Lifestyle & Technologies) 3.Dividend 4.Geography (Country, Region, Global) 5.Shariah Don't worry, we will advise and choose the best suitable fund based on your investment objective, Duration of investment, risk level. |

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |