|

Fixed deposit remains one of the best conservative ways to save your money due to its PROS guaranteed returns, higher interest rates (compared to conventional savings accounts) and protection by PIDM. Have you notice recent Fixed deposit/savings is lower? Let me share with you the latest Fixed Deposit rate offered by different banks & Its Pros & Cons What Happens When You Terminate A Fixed Deposit Early? 1) For fixed deposit accounts of 1 – 3 months Question: If your fixed deposit accounts with terms of one month, two month or three month, you premature withdrawal would see you entitle interest rate? No. Question: Even if you opt to make an early withdrawal one day before the maturity date, you still will enjoy interest rate? No, you will not earn a single sen in interest. 2) For fixed deposit accounts of more than 3 months

Question: 1. If you opt to initiate a premature withdrawal any time you still entitle interest rate? No. Question: If you opt to initiate a premature withdrawal AFTER three months, you will still earn interests? Yes, but only at half of the interest rate you were offered. In another word, 50% of the interest you’ve earned is retained by the bank as charges for early withdrawal.

1 Comment

In Malaysia, the interest rate decisions are taken by The Central Bank of Malaysia (Bank Negara Malaysia). The official interest rate is the Overnight Policy Rate. What is OPR? Overnight Policy Rate (OPR) is an overnight interest rate set by Bank Negara. This overnight policy rate or interest rate is a rate a borrower bank has to pay to a leading bank for the funds borrowed. Still don't understand? Maybe I explain in this way. You may wonder why a bank would be borrowing from another bank, but you must understand that bank makes money by lending money out and not by keeping money. Thus, bank will lend out as much money as possible in terms of loans, and maintaining the minimal cash as requested by Bank Negara. However, in the event that cash withdrawal exceeded the amount of cash available, the particular bank will need to borrow cash from other banks, and make an interest rate, which is the OPR.

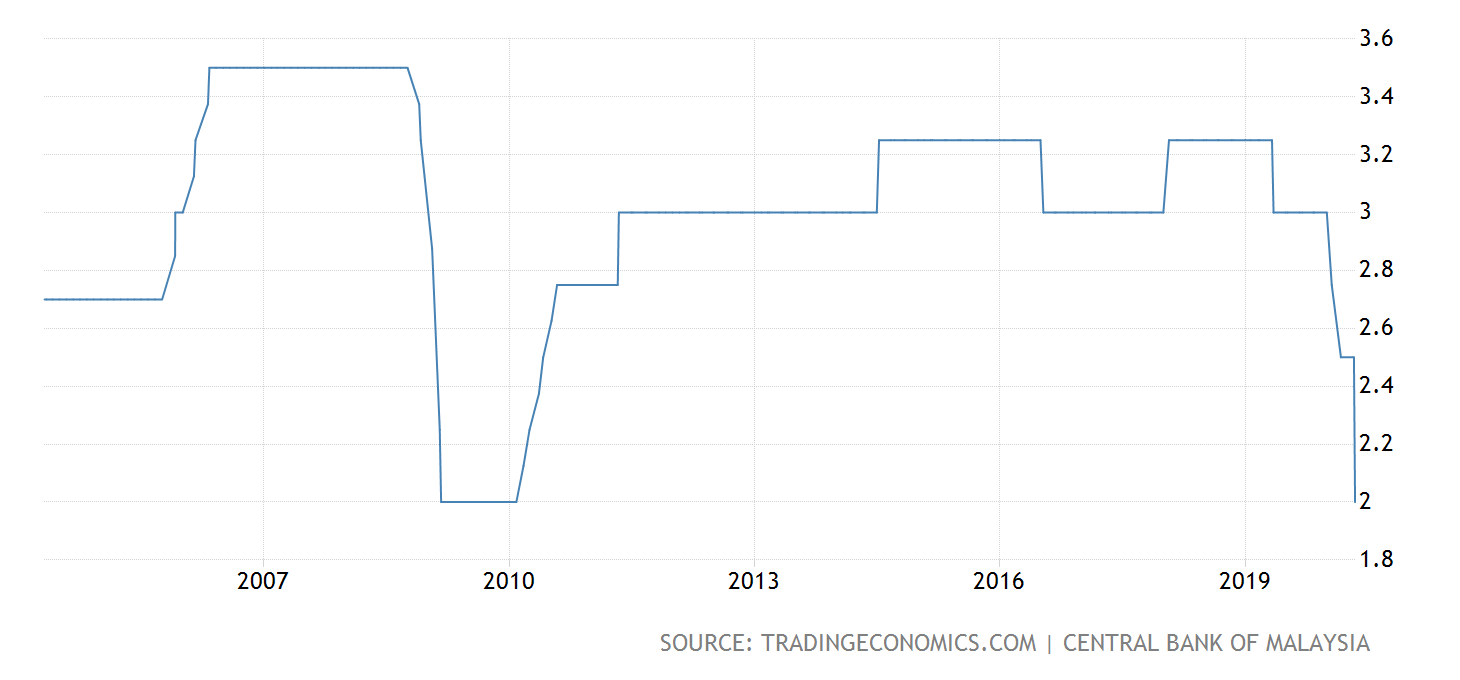

Graph shown the Historical Interest Rate in Malaysia:

https://www.thestar.com.my/business/business-news/2020/07/07/bank-negara-cuts-overnight-policy-rate-by-25bps-to-175 7 JULY 2020: Bank Negara cuts overnight policy rate by 25bps to 1.75% I did a summary of the impact of OPR Cut to the Country & Individual: 1. OPR cut generally positive in impact for businesses and the economy.

2. OPR cut Effect on individual

BFR is a rate determined by Islamic banks based on the cost of lending to consumers. (CASH STUDY) Here’s an example of how this works if OPR cut 0.25% Loan amount : RM500,000 Loan tenure: 30 years BR: 3.65% BR: 3.65% – 0.25%= 3.40% Home loan interest rate Before: 4.45% (3.65% + 0.80%) Monthly repayment : RM2,518.59 Total interest paid over 30 years : RM406,693 After OPR cut: 4.20% (3.40% + 0.80%) Monthly repayment: RM2,445.09 Total interest paid over 30 years : RM380,232.40

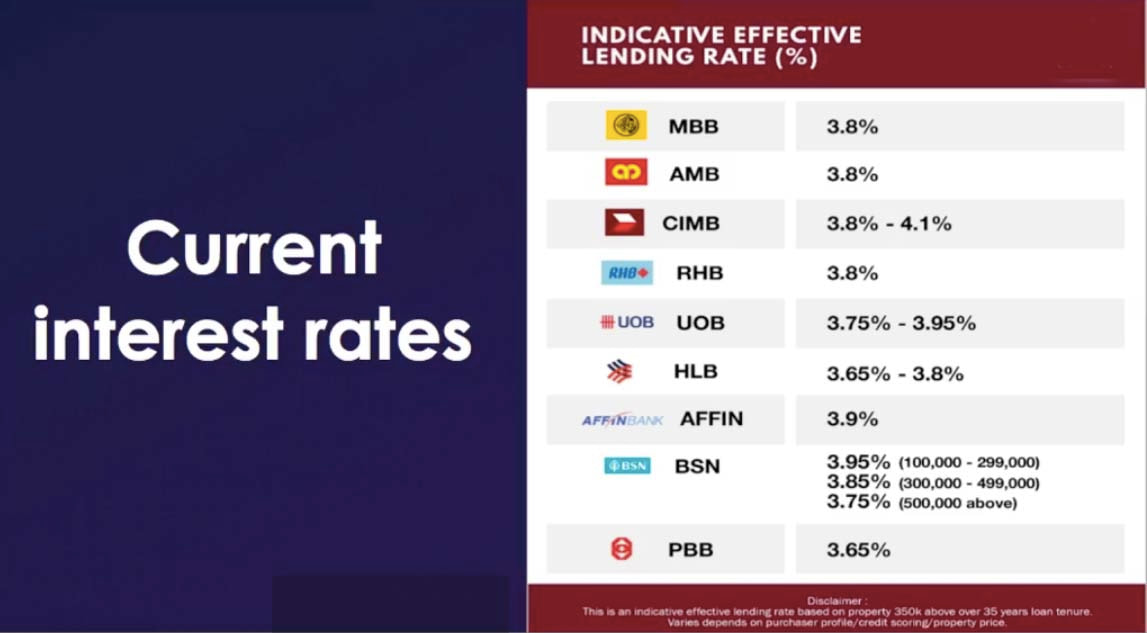

Latest Housing Loan Interest rate as at March 2020 Below is the latest Fixed Deposit rate after OPR cut as your reference

I would highlight some important point from today The Star. Procrastination is one of the mankind's biggest weaknesses. But in the world of finance, procrastination can result in an opportunity loss to mitigate risk and in growing wealth – sometimes an opportunity which can never be recovered. After all, it takes time for any investment to compound into a significant figure Highlight some of the common reasons people use to put off taking actions on their financial matters.

Advice: What you need to do: Take a long hard look at your expenses. This is critical since we are now in challenging economic times. Mindfully track your spending habits for a month and cut back on luxuries that you can live without. If it helps, set up a standing instruction with your bank to automatically transfer a portion of your salary into another bank account. Use that to start investing. Every small portion helps, so don’t think that cutting back on a small luxury is insignificant.

|

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |