|

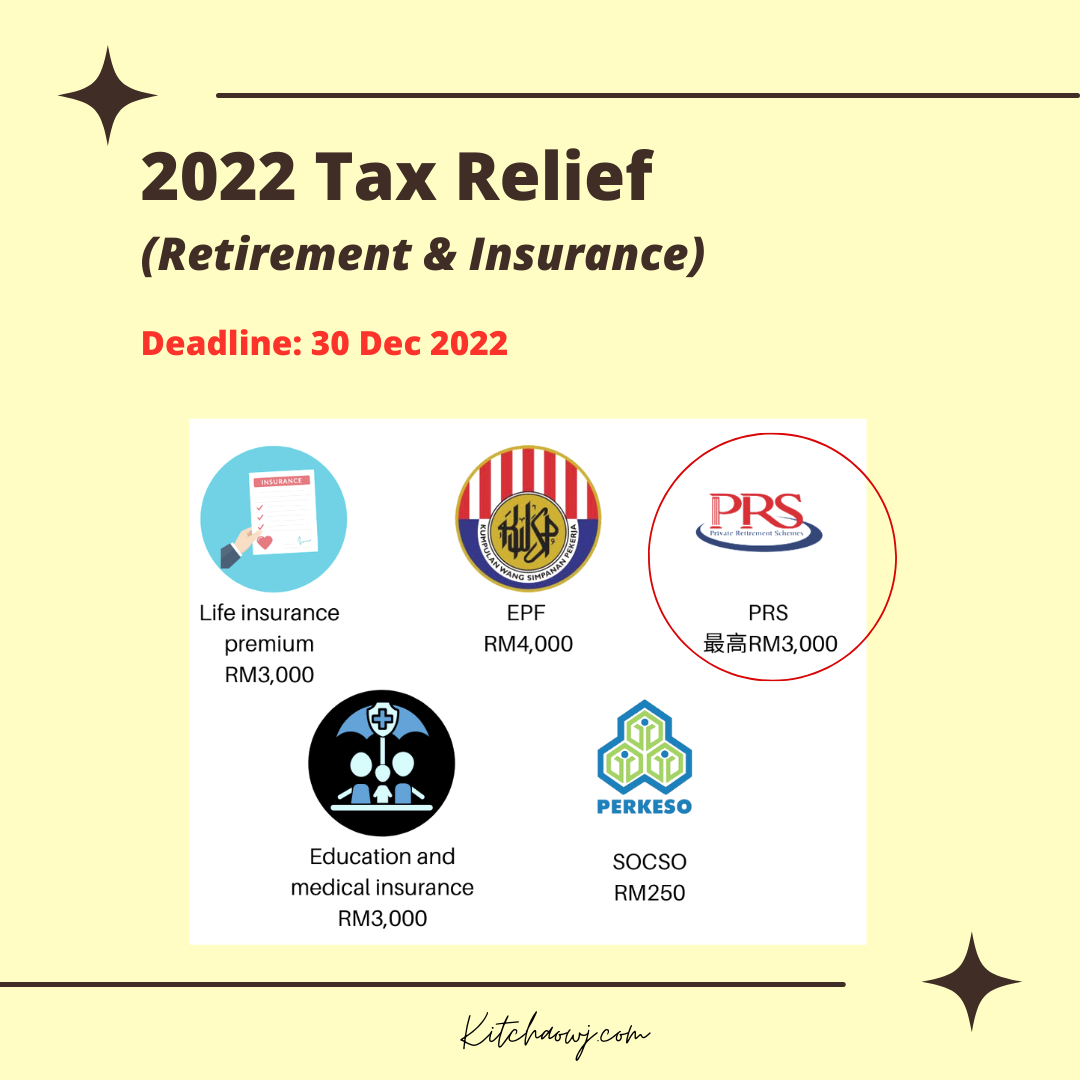

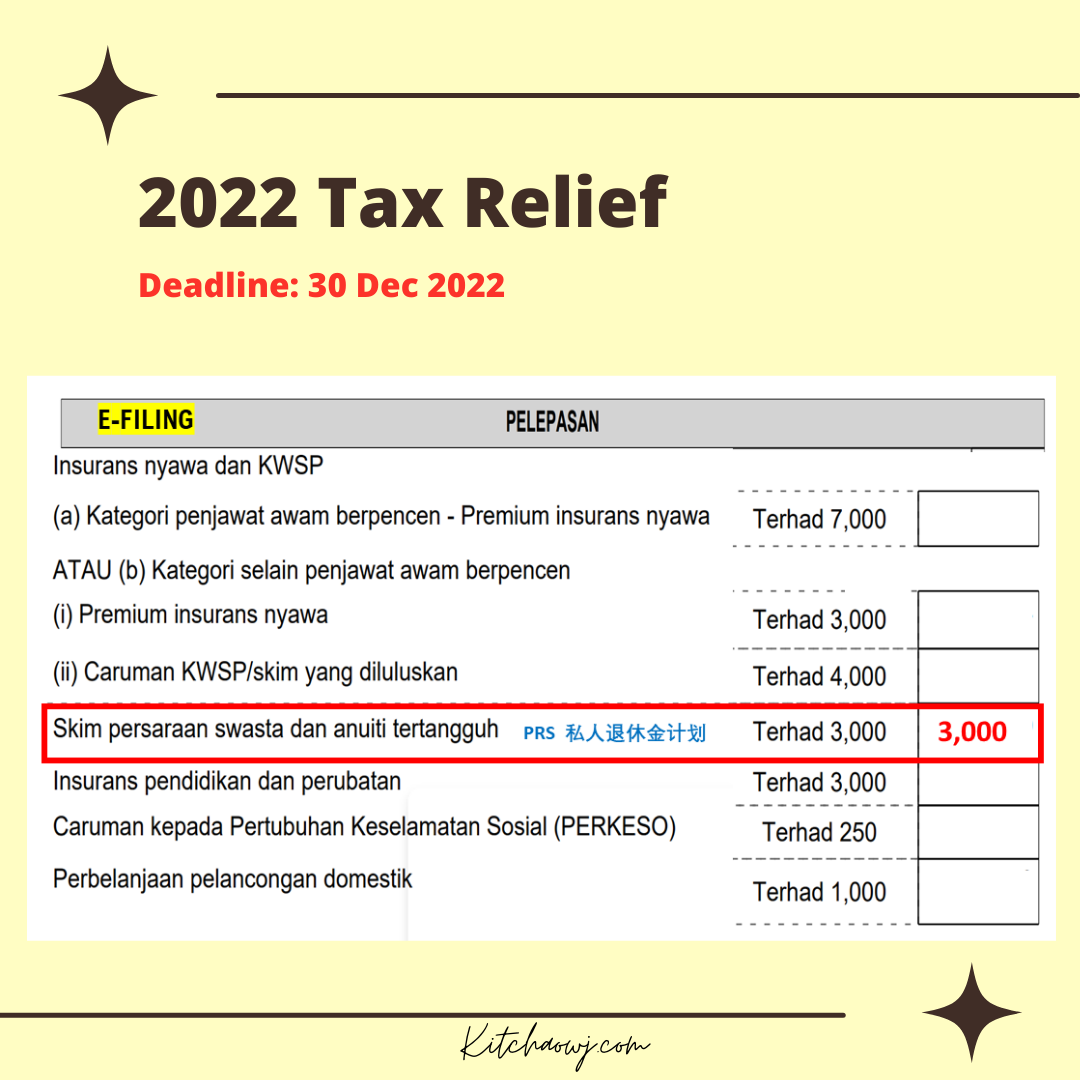

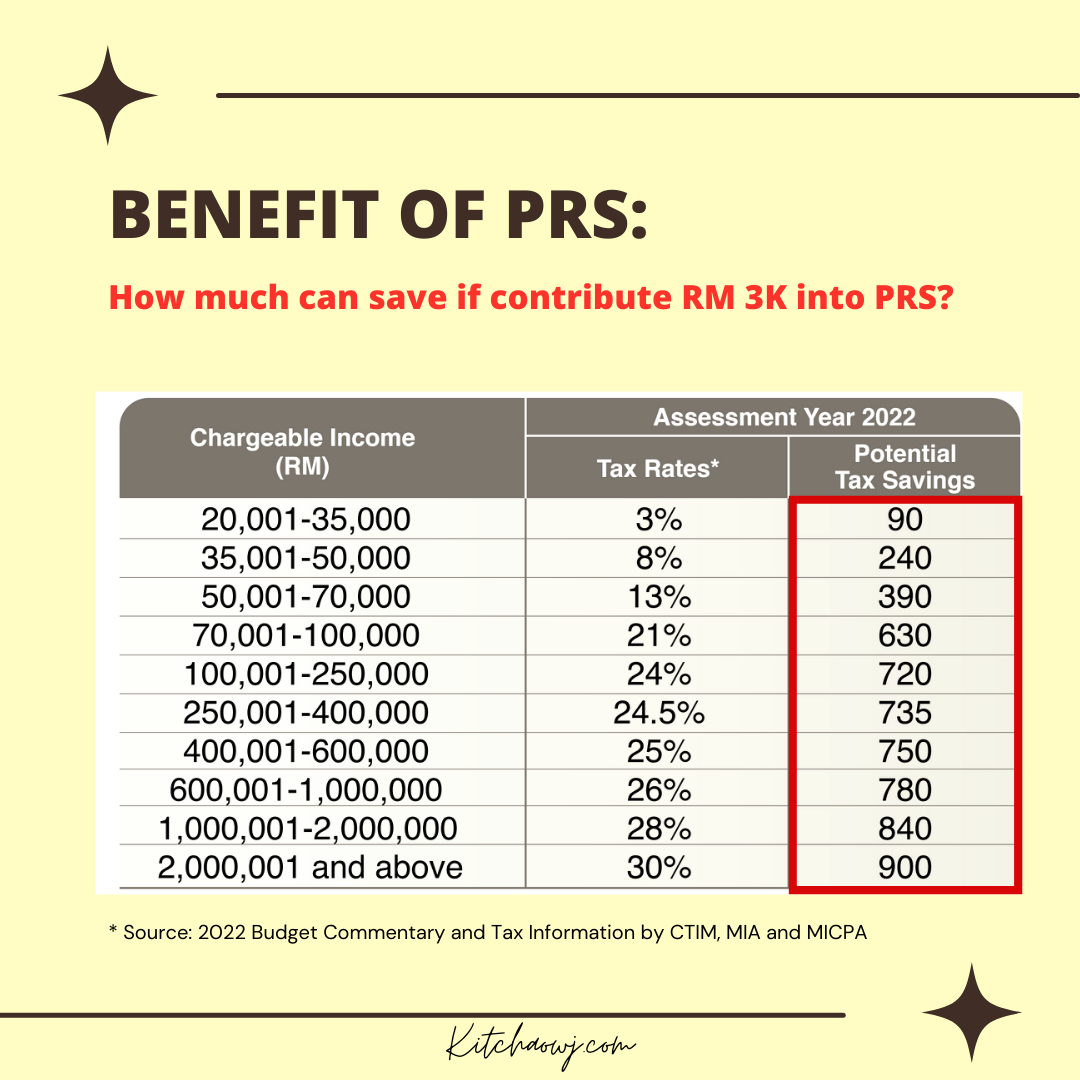

Hello December! It Is the final month of the year 2022. It's a final sprint to fulfilling your tax relief. Have you contributed to your Private Retirement Scheme (PRS) Tax Relief of RM3,000? 1. Why PRS? The PRS Tax Relief was specially introduced to encourage you to save more for your retirement. The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3,000 by the Inland Revenue Board of Malaysia. 2. PRS Tax Relief Column 2. How Much do i Save? This table provides an illustration of the tax savings amount you could enjoy from your annual RM3,000 PRS contributions. For example, if your tax bracket is 24%, your RM3,000 PRS contributions will give you tax savings of RM720. Malaysians cannot afford to retire with just their EPF savings alone. With retirement planning far down the list of priorities among youths, the EPF has consistently stated that a majority of Malaysians do not have enough money in their EPF accounts to last them for long. In 2014 and again in 2017, the EPF found that a staggering 68% of members aged 54 have less than RM50,000 in their EPF accounts, which the EPF estimates will only last them for 4.5 years! This has forced many to delay retirement or find alternate means of income well into old age. To combat the lack of retirement savings, the Private Retirement Scheme (PRS) was introduced in 2012 and sought to encourage people to build their retirement income in another way beyond EPF. By staying on course with a retirement scheme like PRS, you get the best of both worlds – enjoying tax relief whilst saving more for your retirement! happy INVESTMENT!

0 Comments

|

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |