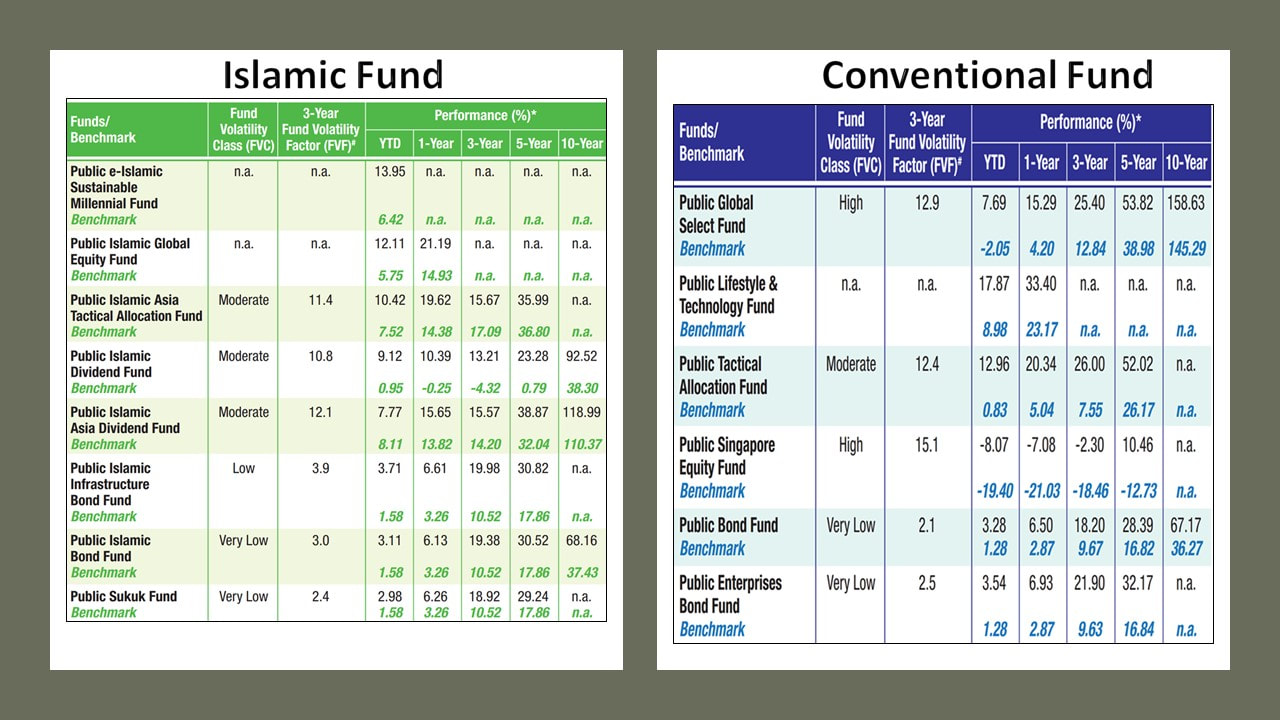

What is your Investment Concern / Interest?1. Looking for better return than savings/FD in view of Lower Interest Rate Environment? 2. Looking for Growth/Technology, Healthcare, Consumer themes that can provide you with resilient long-term earnings growth? 3. Looking for steady return with lower risk fund? Examples of Funds that may Meet Your NeedsOur company has come out a proposal/examples of Funds that may Meet Your Needs for you as reference. Fund Performance as at 30 June 2020:Note: High Risk, High Return. For further info can refer to the below attachment:

0 Comments

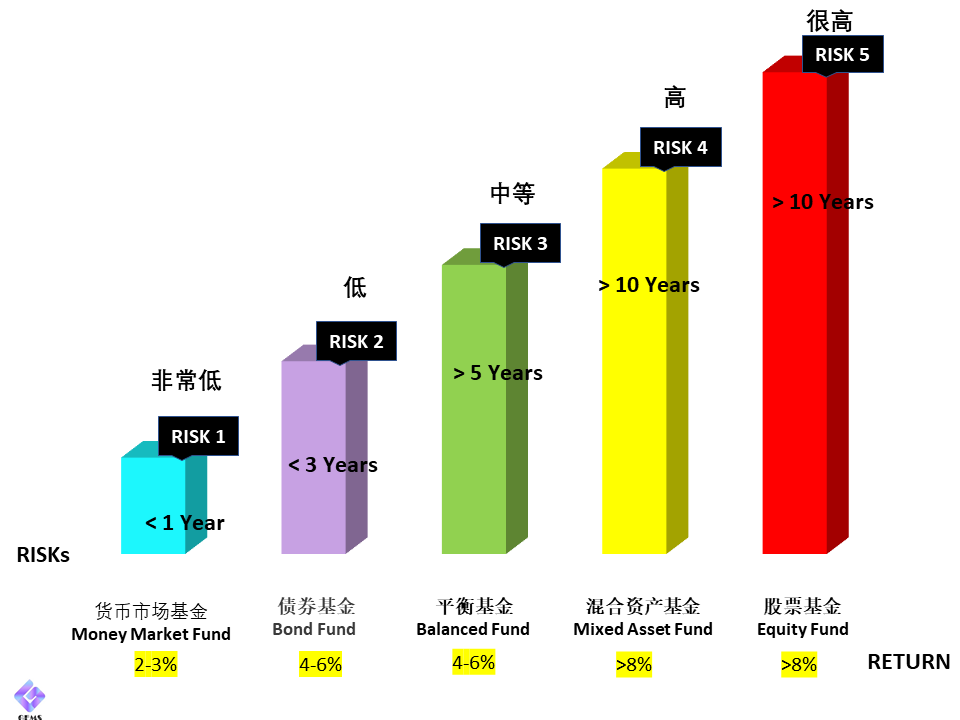

1. Unit Trust Basic Knowledge (信托基金的基本介绍) What is Unit Trust Scheme? 什么是信托基金 ?A Unit Trust Scheme (UTS) is a form of collective investment scheme (CIS) that allows investors with similar investment objectives to pool their savings, which are then invested in a portfolio of securities or other assets managed by investment professionals. 信托投资基金 即集合不特定的投资者,将资金集中起来,设立投资基金,并委托具有专门知识和经验的投资专家经营操作,使中小投资者都能在享受国际投资的丰厚报酬不同的减少投资风险. 简单来说就是累积一群投资者的钱,然后让专业的投资经理跟着基金的投资目的去投资,然后把投资净赚的钱,平均分配给基金单位持有者。 Classifications of Unit Trust Scheme 信托基金的种类Unit Trust divided into 5 category risk of fund from lowest risk (1) to highest risk (5) 信托基金的类别根据风险可以被分为5大类别。由 (1) 最低 – (5)) 最高 很多投资者都会问相同的问题。哪一个FUND 最赚钱?

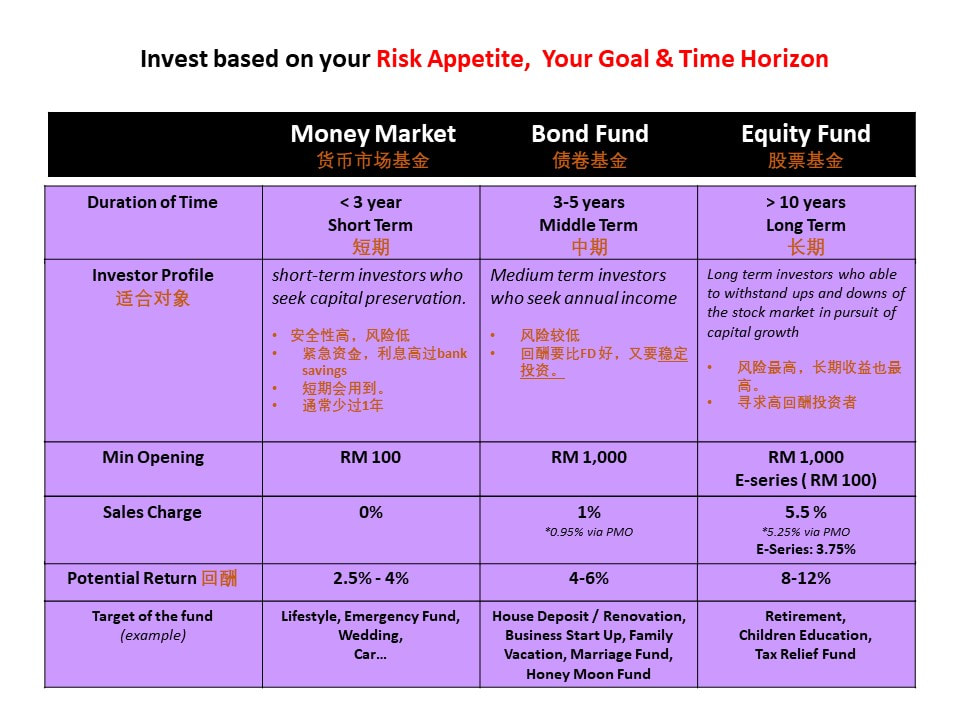

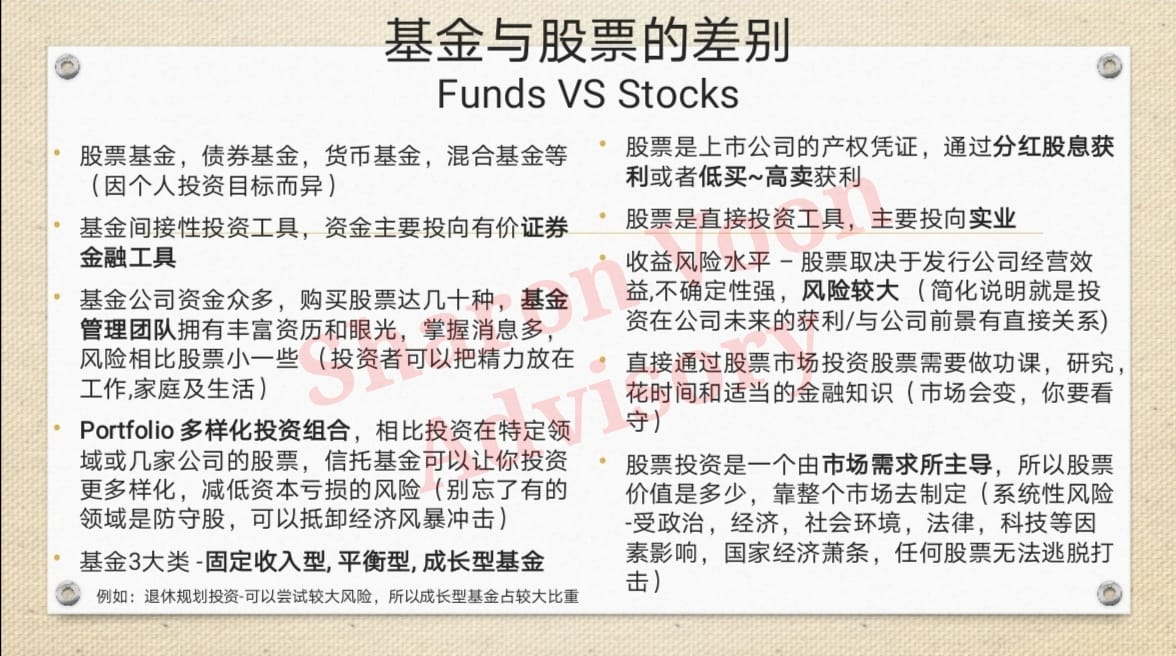

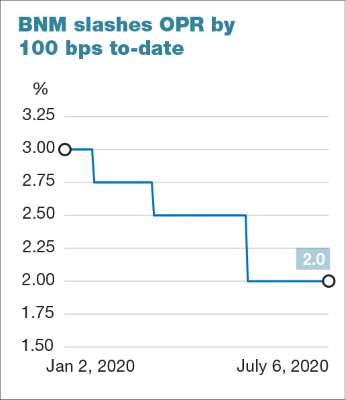

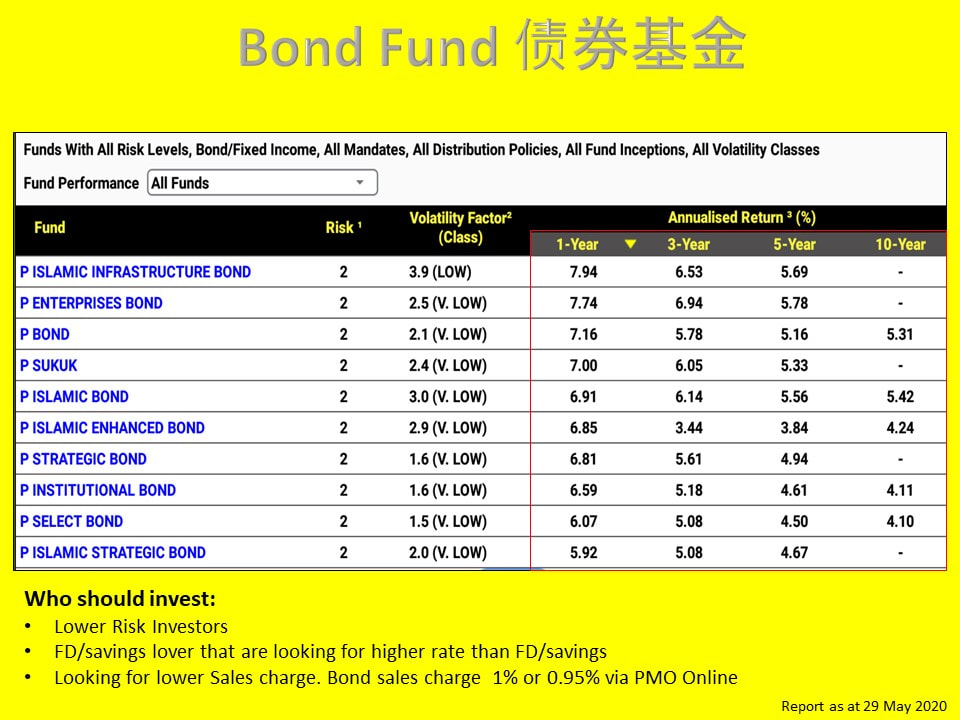

可以参考如下:这里我把基金和股票的差别列出来: 我简单的把基金分类如下:* 货币市场基金(Money Market Fund)货币市场基金(Money Market Fund)是信托基金的其中一种。MMF基本上就和FD是一样的,MMF是筹集大家的钱然后向银行要求更好的存款利率,而FD就是你个人的钱。当你持有大数额金钱的时候,你跟银行谈判的筹码也多了,得到的利率自然比较好。 * 债券基金(Bond Fund)2020年,国行第四次降息。国家银行已将隔夜政策利率(OPR)调降25个基点,至1.75%的纪录低位。(16年最低)。这也造成了现在的银行定期(FD)利息特别低,所以如果你要寻利息高过FD, 又不想风险高的,建议你可以考虑债卷基金。 * 股票基金(Equity Fund)-最热销Something you need to know: Some of you might ask what is OPR 马来西亚隔夜政策利率? OPR is the central bank’s policy rate used by banks to set interest rates for loans. OPR是马来西亚银行设定贷款利率的指南。 The OPR is determined by Bank Negara Malaysia (BNM) on a variety of factors and serves as a guide for local banks to determine their own lending rates, both to each other and to the consumer, so cut of OPR will of course bring pros and cons to consumer. It is used to manage the supply and demand for money in the market and forms the backbone of monetary policy. 就是一家金融机构利用手头上充裕的资金借出给另一家金融机构的短期贷款利率(通常是隔夜计算),而这种利率只在各金融机构里互相流通。 Everyone especially households and business owners are waiting to see if Bank Negara Malaysia at its Monetary Policy Committee (MPC) meeting today will trim OPR further to stimulate growth in current economic tough times. Well, lower interest rates will ease the debt burdens on companies and consumers. It is not surprising when BNM announce the cut of OPR today, mark our Bank Negara Malaysia’s 4th policy easing this year, a period in which the economy has faced a triple whammy of coronavirus pandemic, low oil prices and political uncertainty. What about other country?

I did a overview of the interest rate cut this year as below. Source:

The Cut is Good for Country's economy According to The STAR on 7 July 2020, the decision to reduce the OPR is aimed at accelerating the rate of recovery and further stimulate the country's economy. Another way it means to help the economy recover because it supports consumption and investment spending. "The government believes that this move, combined with proactive measures deployed since March 2020 under the PRIHATIN and PRIHATIN SME+ economic stimulus packages and, more recently the National Economic Recovery Plan (PENJANA), will be able to regenerate the economy by creating jobs, restoring consumer and investor confidence, as well as containing the likelihood of a sharp economic contraction, Savers looking for more returns on their savings accounts and fixed deposits will be disappointed. I I believe further interest rates for these savings instruments will be reduced in tandem with the OPR cut. Advice: We must re-assess our savings or investment strategy to ensure we still get the most optimal returns. The Lower OPR means you are now able to obtain loans from the bank at a lower rate. Borrowers of flexible interest rate loans will enjoy lower loan servicing payments once banks adjust their base lending rates. A number of banks have since adjusted their rates. I take one example: 1. If you took a personal five-year loan of RM50,000 at 7% interest, with the OPR cut you will be paying RM20 less in monthly instalments. 2. For a 30-year mortgage loan of RM300,000, the monthly instalment is reduced by about RM100 if the bank’s interest rate is reduced correspondingly from 4.5% to 4.0. Lower borrowing costs would encourage businesses and households, particularly those with good credit scores, to consider taking on new loans. People will slowly transfer out their savings due to the lower savings/FD rates and put in investment which can provide higher return. When people started to invest in stocks market will help to stimulate economy's growth. Malaysia ringgit’s weakening also means that goods from overseas will be more expensive. This can potentially affect the country’s economic growth, as many of Malaysia’s projects designed to spur growth are dependent on imports such as highly sophisticated machinery, construction materials, foreign consultant services etc. OPR reduced will weaken Malaysia Ringgit also. As the weaker ringgit means Malaysian goods will be relatively cheaper compared to their competitors worldwide. Hence, the increased exports should therefore increase output and investment in local enterprises, increasing the opportunities for employment for you and me. Conclusion:When the country experiences strong economic growth, the central bank will consider higher OPRs to discourage overspending as the latter might lead to increased inflation for the country as a whole. The higher lending rates that come with increased OPRs will also mean higher interest rates that attract savings in the banks, discourage indiscriminate borrowing and encourages responsible spending. Alternatively, when the economy is generally found to be slowing the central bank will then consider lower OPR bands to encourage domestic spending, and help GDP growth. This has been used effectively in large economies to spur economic growth, for example in the US, where rates reach 0% with direct liquidity injections conducted through quantitative easing to support the local economy. Is there an alternative for FD/savings account?1. Do you want an investment that offers a steady cash flow & yet provide stability (lower risk fund) ? 2. Do you have any Fixed deposit going to due? 3. Do you put all your savings in bank/FD? 4. Do you aware with the lower saving/FD rates offered by bank after the 4th cut in OPR? For your info:

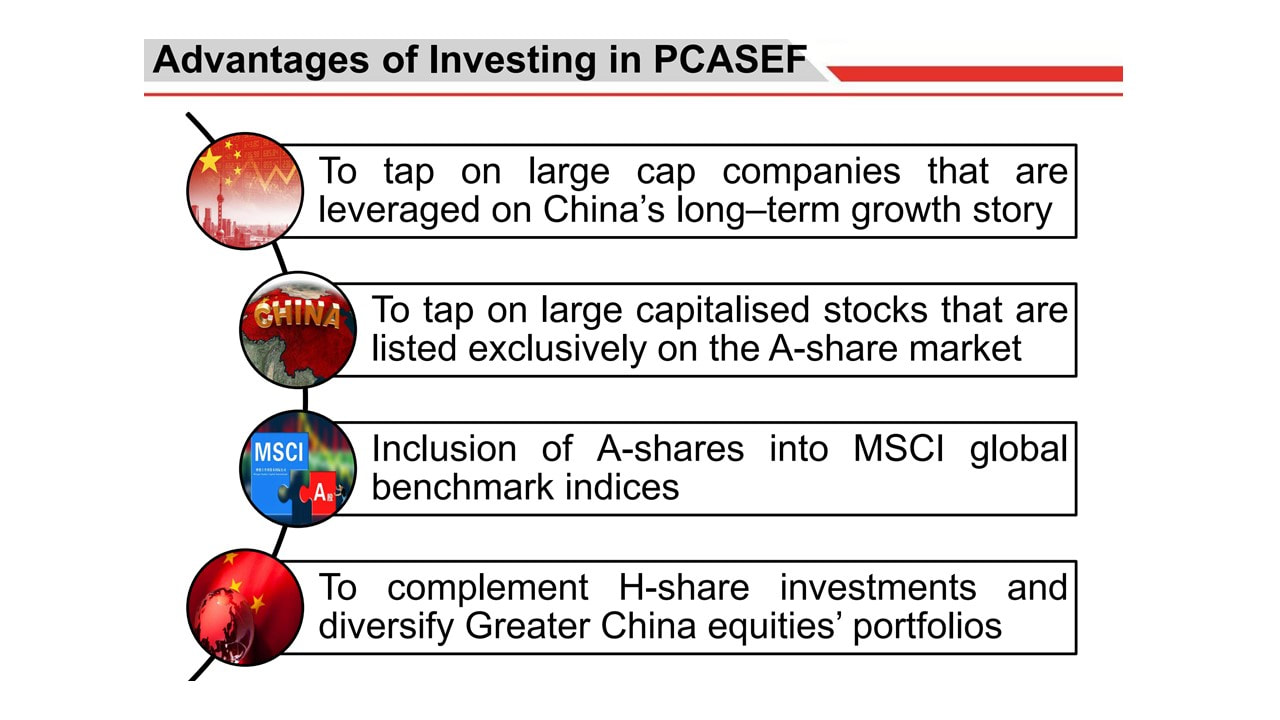

隔夜政策利率 OPR - Overnight Policy Rate 的由来? 马来西亚国家银行在2004年引用银行隔夜政策利率(Overnight Policy Rate ,OPR)为政府货币政策和管制市场游资的新指标,其用意旨在加强银行体系的良性竞争,为经济带来正面影响。 马来西亚的隔夜政策利率相当于美国的贴现率,是国家银行贷款给商业银行的政策利率;因此,隔夜政策利率的水平,也间接决定了银行发给存款人的利息及贷款利息水平。国家银行让个别银行自定贷款利率,但控制存款利率,可确保存户取得实际的正面回酬,不会受银行利率赚幅压缩的影响。根据国家银行的说法,选定OPR为指标利率,主要是此指标利率相对较稳定,国银仍可通过此利率调控货币政策。在这个利率架构下,如果国银调高OPR,即是紧缩货币政策,反之,就是放宽,整体政策更具透明度。 从此以后,OPR 就成了马来西亚人民最关注的利率指标之一。 I'm glad that we have the opportunities in China 'A' Share.- Public China Access Equity Fund. Our china funds are mainly invested in 'H' Share all this while for intance: Public Greater China Fund, Public China Ittikal Fund, Public China Titan Fund. I want to highlight one thing here: so basically, Public China Access Equity Fund Concentrated in large-capitalization stocks listed on the China A-share market whereas Public Mutual’ s Other China Funds Largely focus on H-shares market & Also invest in Hong Kong and Taiwan stocks. What you think about 'A' Share fund? some differences between 'A' Share vs 'H' ShareWhat is the differences between 'A' Share and 'H' Share?China incorporated companies listed in the People’s Republic of China (PRC) can issue different classes of share depending on where they are listed and which investors are allowed to own them. The classes are A, B and H, which are all renminbi-denominated shares but traded in different currencies, depending on where they are listed. Publicly traded companies in China generally fall under three share categories:

Fund Objective of PCASEFTo achieve capital growth over the medium to long term period by investing in a portfolio of investments in the China market and including China-based companies* listed on domestic and foreign markets. Below is our China fund comparison: Who Should Invest? This Fund is suitable for medium to long-term investors who are able to withstand ups and downs of the stock market in pursuit of capital growth. For a better investment result, you need to determine your fund purpose. Don't ever utilise emergency fund to invest into higher risk fund. For emergency fund, we have Cash deposit fund to cater for you.

|

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |

|||||||||||||||||||||||||||||||