|

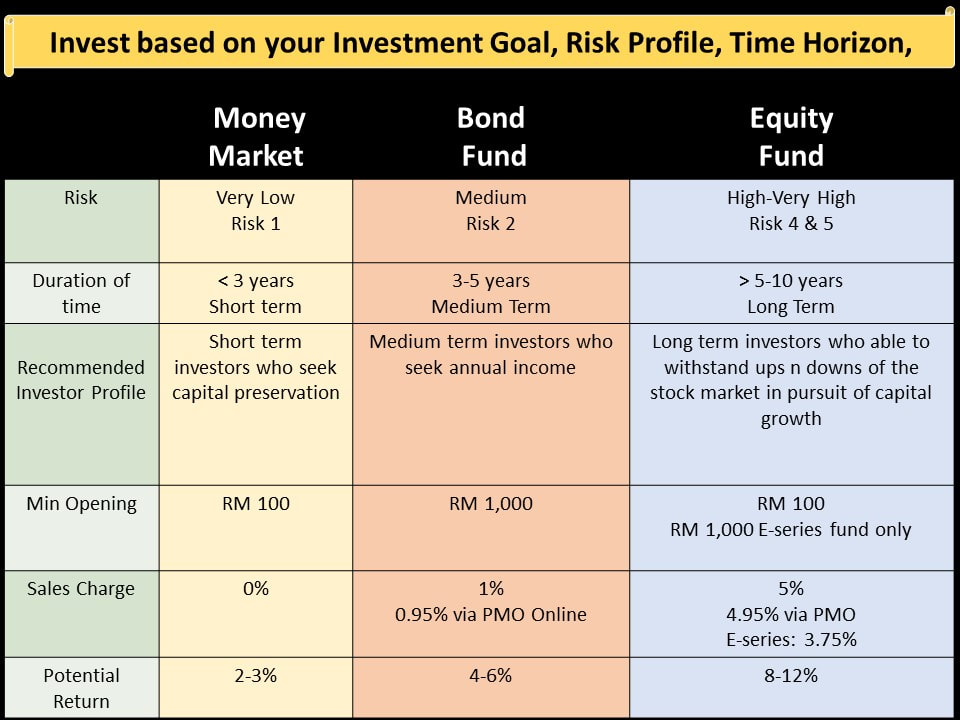

There are 3 main Type of Fund:

I notice that people's first impression toward unit trust fund is that all funds are high risk fund. In fact there are lowest risk fund namely money market fund and bond fund. I did a simple explanation for a better understanding on different fund, there is different risk, different return and loss. Hope it helps you to choose a better, suitable fund. Summary:with just 5 min read, you got better understanding ..1. Money Market Fund (Lowest Risk, Emergency Fund)What Is MM

Fund Objective

Suitable To

Return

Suggestion Investment Period

WHAT IS MONEY MARKET BENEFITS: •Min opening: RM 100 only •0% Service Charge •Flexible to withdraw, 2-3 working days. •Safe, Lowest Risk •Invest/redeem via PMO online, very convenient. •Free Fund Consultation 2. Bond Fund (Medium Risk)

What is Bond Fund: Investing into debt securities issue by Government & Corporations. Debt securities issue by

Suitable To:

Return: 4-6% per annum Suggestion Investment Period

WHAT IS BOND FUND BENEFITS:

3. Equity Fund (High/Very High Risk)What is:

Suitable to:

Return: 8-12% Suggestion Investment Period

NOTE: There is not a contract basis for the investment period. That is a recommended investment period only. There is no exit fees/penalty for the early redemption . HOTTEST FUND-EQUITY FUND!!!!

Each Equity fund is differentiated based on its investment features 1.Market Capitalisation (Large Cap, Mid Cap, Small Cap) 2.Sector (property, consumer, telco & infrastructure, Lifestyle & Technologies) 3.Dividend 4.Geography (Country, Region, Global) 5.Shariah Don't worry, we will advise and choose the best suitable fund based on your investment objective, Duration of investment, risk level.

0 Comments

Leave a Reply. |

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |