|

In Malaysia, the interest rate decisions are taken by The Central Bank of Malaysia (Bank Negara Malaysia). The official interest rate is the Overnight Policy Rate. What is OPR? Overnight Policy Rate (OPR) is an overnight interest rate set by Bank Negara. This overnight policy rate or interest rate is a rate a borrower bank has to pay to a leading bank for the funds borrowed. Still don't understand? Maybe I explain in this way. You may wonder why a bank would be borrowing from another bank, but you must understand that bank makes money by lending money out and not by keeping money. Thus, bank will lend out as much money as possible in terms of loans, and maintaining the minimal cash as requested by Bank Negara. However, in the event that cash withdrawal exceeded the amount of cash available, the particular bank will need to borrow cash from other banks, and make an interest rate, which is the OPR.

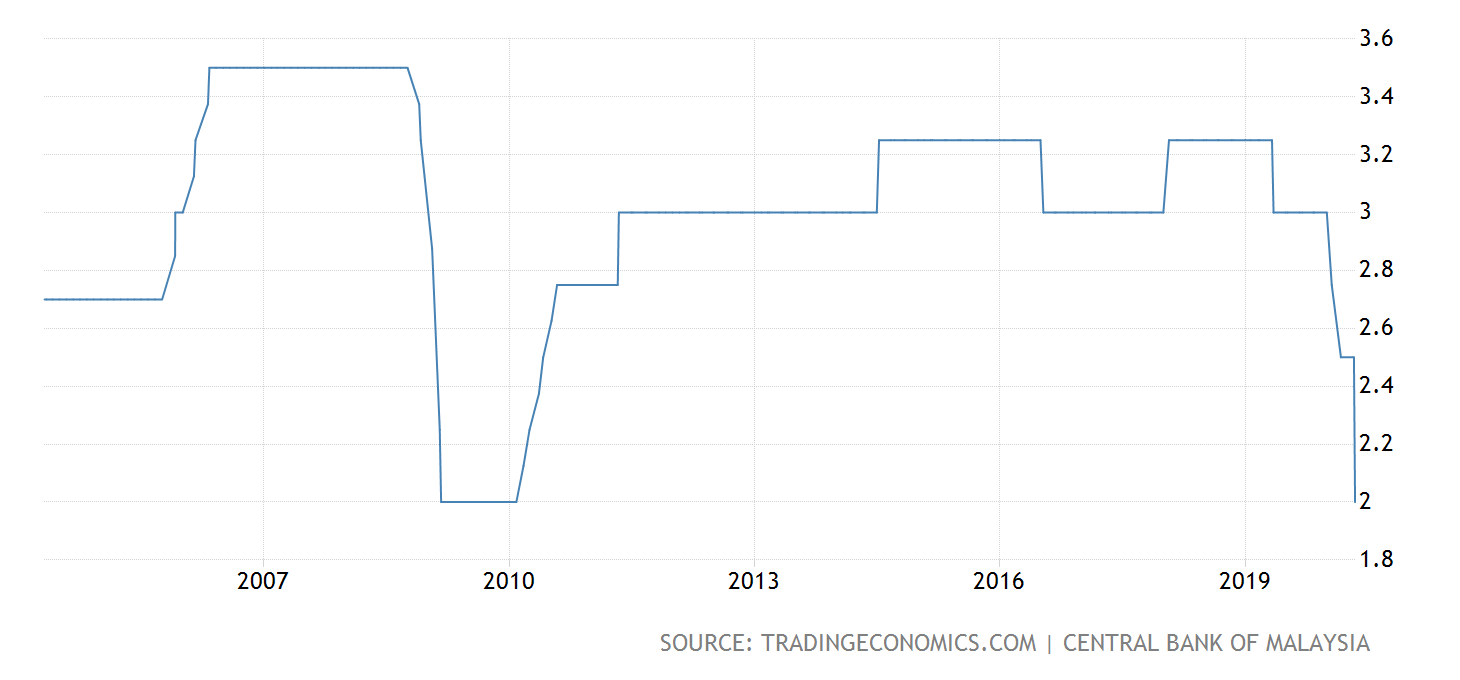

Graph shown the Historical Interest Rate in Malaysia:

https://www.thestar.com.my/business/business-news/2020/07/07/bank-negara-cuts-overnight-policy-rate-by-25bps-to-175 7 JULY 2020: Bank Negara cuts overnight policy rate by 25bps to 1.75% I did a summary of the impact of OPR Cut to the Country & Individual: 1. OPR cut generally positive in impact for businesses and the economy.

2. OPR cut Effect on individual

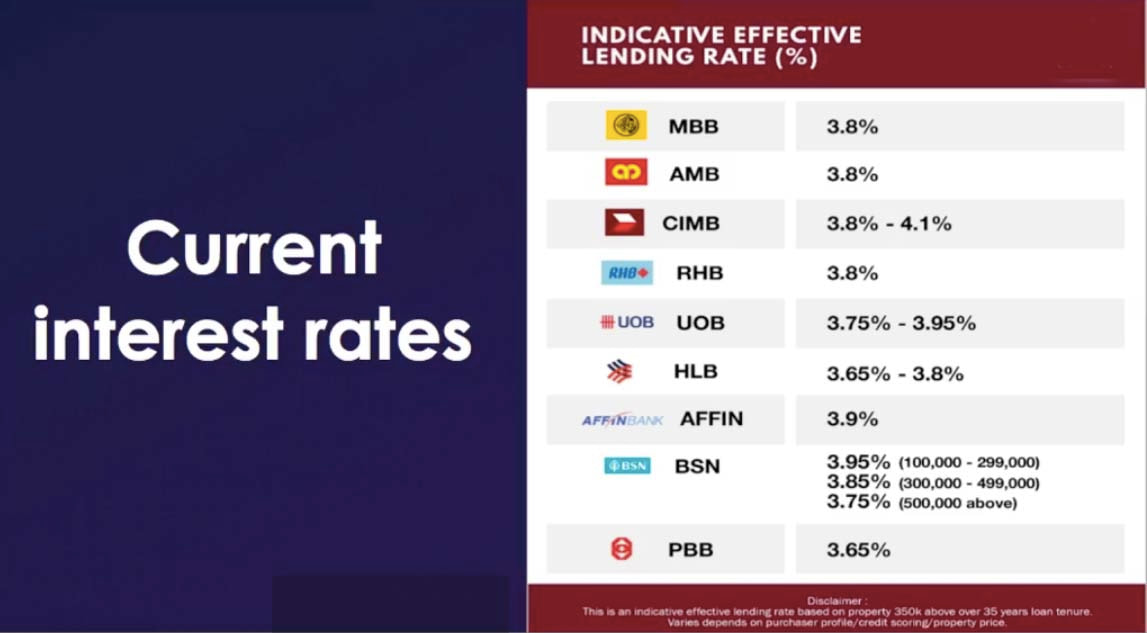

BFR is a rate determined by Islamic banks based on the cost of lending to consumers. (CASH STUDY) Here’s an example of how this works if OPR cut 0.25% Loan amount : RM500,000 Loan tenure: 30 years BR: 3.65% BR: 3.65% – 0.25%= 3.40% Home loan interest rate Before: 4.45% (3.65% + 0.80%) Monthly repayment : RM2,518.59 Total interest paid over 30 years : RM406,693 After OPR cut: 4.20% (3.40% + 0.80%) Monthly repayment: RM2,445.09 Total interest paid over 30 years : RM380,232.40

Latest Housing Loan Interest rate as at March 2020 Below is the latest Fixed Deposit rate after OPR cut as your reference

0 Comments

Leave a Reply. |

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |