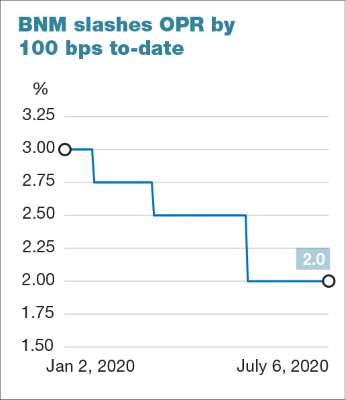

Something you need to know: Some of you might ask what is OPR 马来西亚隔夜政策利率? OPR is the central bank’s policy rate used by banks to set interest rates for loans. OPR是马来西亚银行设定贷款利率的指南。 The OPR is determined by Bank Negara Malaysia (BNM) on a variety of factors and serves as a guide for local banks to determine their own lending rates, both to each other and to the consumer, so cut of OPR will of course bring pros and cons to consumer. It is used to manage the supply and demand for money in the market and forms the backbone of monetary policy. 就是一家金融机构利用手头上充裕的资金借出给另一家金融机构的短期贷款利率(通常是隔夜计算),而这种利率只在各金融机构里互相流通。 Everyone especially households and business owners are waiting to see if Bank Negara Malaysia at its Monetary Policy Committee (MPC) meeting today will trim OPR further to stimulate growth in current economic tough times. Well, lower interest rates will ease the debt burdens on companies and consumers. It is not surprising when BNM announce the cut of OPR today, mark our Bank Negara Malaysia’s 4th policy easing this year, a period in which the economy has faced a triple whammy of coronavirus pandemic, low oil prices and political uncertainty. What about other country?

I did a overview of the interest rate cut this year as below. Source:

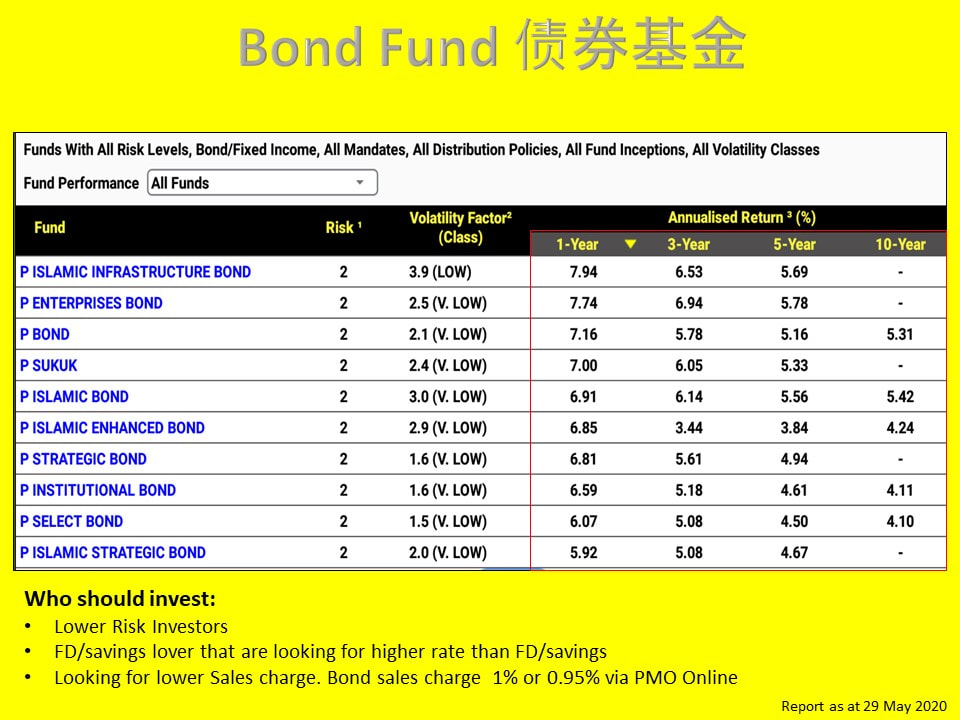

The Cut is Good for Country's economy According to The STAR on 7 July 2020, the decision to reduce the OPR is aimed at accelerating the rate of recovery and further stimulate the country's economy. Another way it means to help the economy recover because it supports consumption and investment spending. "The government believes that this move, combined with proactive measures deployed since March 2020 under the PRIHATIN and PRIHATIN SME+ economic stimulus packages and, more recently the National Economic Recovery Plan (PENJANA), will be able to regenerate the economy by creating jobs, restoring consumer and investor confidence, as well as containing the likelihood of a sharp economic contraction, Savers looking for more returns on their savings accounts and fixed deposits will be disappointed. I I believe further interest rates for these savings instruments will be reduced in tandem with the OPR cut. Advice: We must re-assess our savings or investment strategy to ensure we still get the most optimal returns. The Lower OPR means you are now able to obtain loans from the bank at a lower rate. Borrowers of flexible interest rate loans will enjoy lower loan servicing payments once banks adjust their base lending rates. A number of banks have since adjusted their rates. I take one example: 1. If you took a personal five-year loan of RM50,000 at 7% interest, with the OPR cut you will be paying RM20 less in monthly instalments. 2. For a 30-year mortgage loan of RM300,000, the monthly instalment is reduced by about RM100 if the bank’s interest rate is reduced correspondingly from 4.5% to 4.0. Lower borrowing costs would encourage businesses and households, particularly those with good credit scores, to consider taking on new loans. People will slowly transfer out their savings due to the lower savings/FD rates and put in investment which can provide higher return. When people started to invest in stocks market will help to stimulate economy's growth. Malaysia ringgit’s weakening also means that goods from overseas will be more expensive. This can potentially affect the country’s economic growth, as many of Malaysia’s projects designed to spur growth are dependent on imports such as highly sophisticated machinery, construction materials, foreign consultant services etc. OPR reduced will weaken Malaysia Ringgit also. As the weaker ringgit means Malaysian goods will be relatively cheaper compared to their competitors worldwide. Hence, the increased exports should therefore increase output and investment in local enterprises, increasing the opportunities for employment for you and me. Conclusion:When the country experiences strong economic growth, the central bank will consider higher OPRs to discourage overspending as the latter might lead to increased inflation for the country as a whole. The higher lending rates that come with increased OPRs will also mean higher interest rates that attract savings in the banks, discourage indiscriminate borrowing and encourages responsible spending. Alternatively, when the economy is generally found to be slowing the central bank will then consider lower OPR bands to encourage domestic spending, and help GDP growth. This has been used effectively in large economies to spur economic growth, for example in the US, where rates reach 0% with direct liquidity injections conducted through quantitative easing to support the local economy. Is there an alternative for FD/savings account?1. Do you want an investment that offers a steady cash flow & yet provide stability (lower risk fund) ? 2. Do you have any Fixed deposit going to due? 3. Do you put all your savings in bank/FD? 4. Do you aware with the lower saving/FD rates offered by bank after the 4th cut in OPR? For your info:

隔夜政策利率 OPR - Overnight Policy Rate 的由来? 马来西亚国家银行在2004年引用银行隔夜政策利率(Overnight Policy Rate ,OPR)为政府货币政策和管制市场游资的新指标,其用意旨在加强银行体系的良性竞争,为经济带来正面影响。 马来西亚的隔夜政策利率相当于美国的贴现率,是国家银行贷款给商业银行的政策利率;因此,隔夜政策利率的水平,也间接决定了银行发给存款人的利息及贷款利息水平。国家银行让个别银行自定贷款利率,但控制存款利率,可确保存户取得实际的正面回酬,不会受银行利率赚幅压缩的影响。根据国家银行的说法,选定OPR为指标利率,主要是此指标利率相对较稳定,国银仍可通过此利率调控货币政策。在这个利率架构下,如果国银调高OPR,即是紧缩货币政策,反之,就是放宽,整体政策更具透明度。 从此以后,OPR 就成了马来西亚人民最关注的利率指标之一。

0 Comments

Leave a Reply. |

AuthorPromote financial literacy from simple approach, create awareness on financial planning and make better decision in financial planning. Article

July 2023

Categories |